Saudi Arabia’s Promising Logistics Role

The kingdom has begun to diversify its non-oil economy. Where launching rapidly an ambitious path to become a leading logistics hub in the Gulf area and its environs

In April 2016, Saudi Arabia has announced its Vision 2030.One of the most important pillars of this vision is to transform the Kingdom into the preferred logistics hub in the area, capable of trade paths effective connectivity between three continents - Asia, Europe, and Africa. Today, about 18 months since the launch of the vision, this path started to be clear with efforts continue to make imports and exports processes more streamlined. Restructuring the regulations and structures logistics sector government and opening the way for market liberalization and private sector participation. Public-private partnerships are formed to finance infrastructure and attract the skills from the experts. Thus, by 2030, Saudi Arabia is expected to be among the most important logistics hub in the area.

-

Establishing a global logistics hub

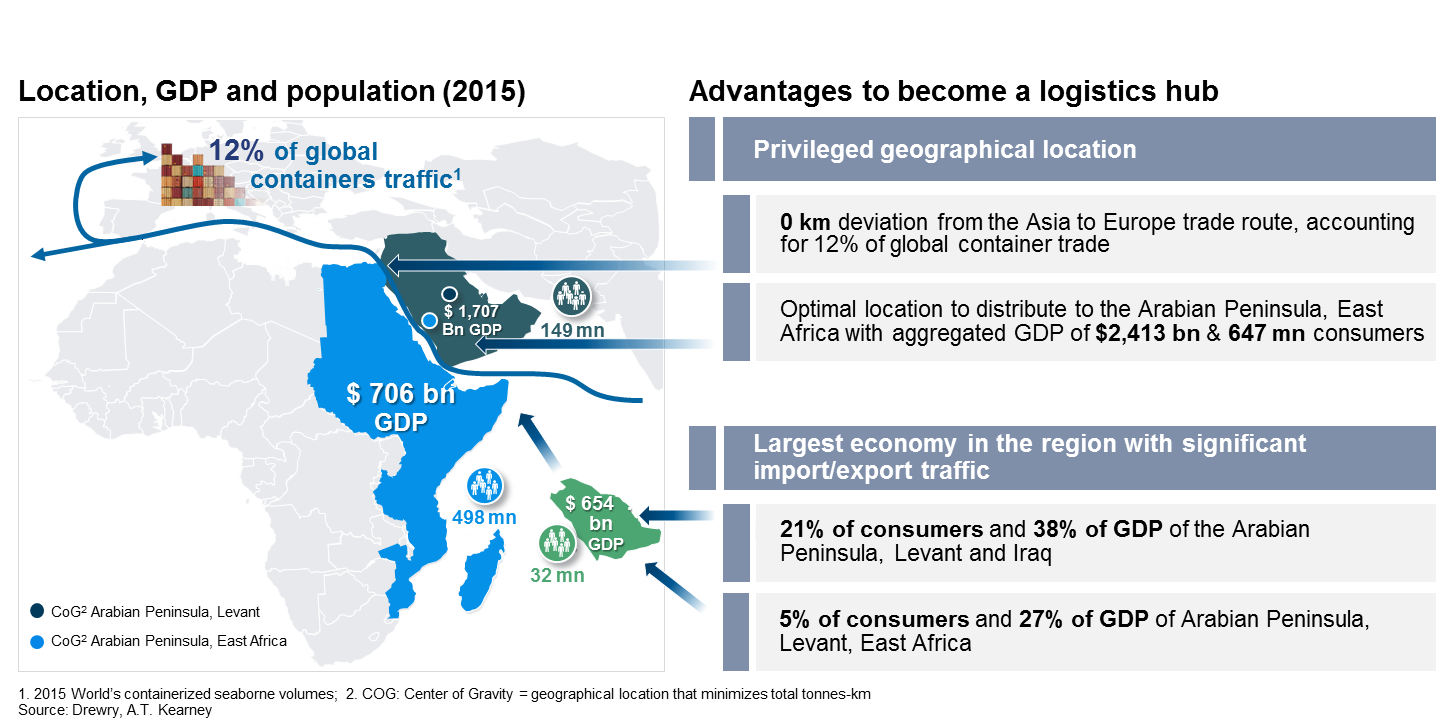

Saudi Arabia's insistence to become a leading logistics hub in the area is based on its economic weight and its particular geographical location. The Kingdom have the largest economy in the Arabian Peninsula, Levant and Iraq. Which contribute about 38% of gross domestic product and 21%of the population in this area. Its central location is ideal for the distribution to Arabian Peninsula, Levant, and East Africa. Also, it is located directly on the Asia-Europe trade route, which 12% of the container trade passes annually. (see Figure 1).

Figure 1: The Factors that qualify the Kingdom to become a logistics hub.

Figure 1: The Factors that qualify the Kingdom to become a logistics hub.

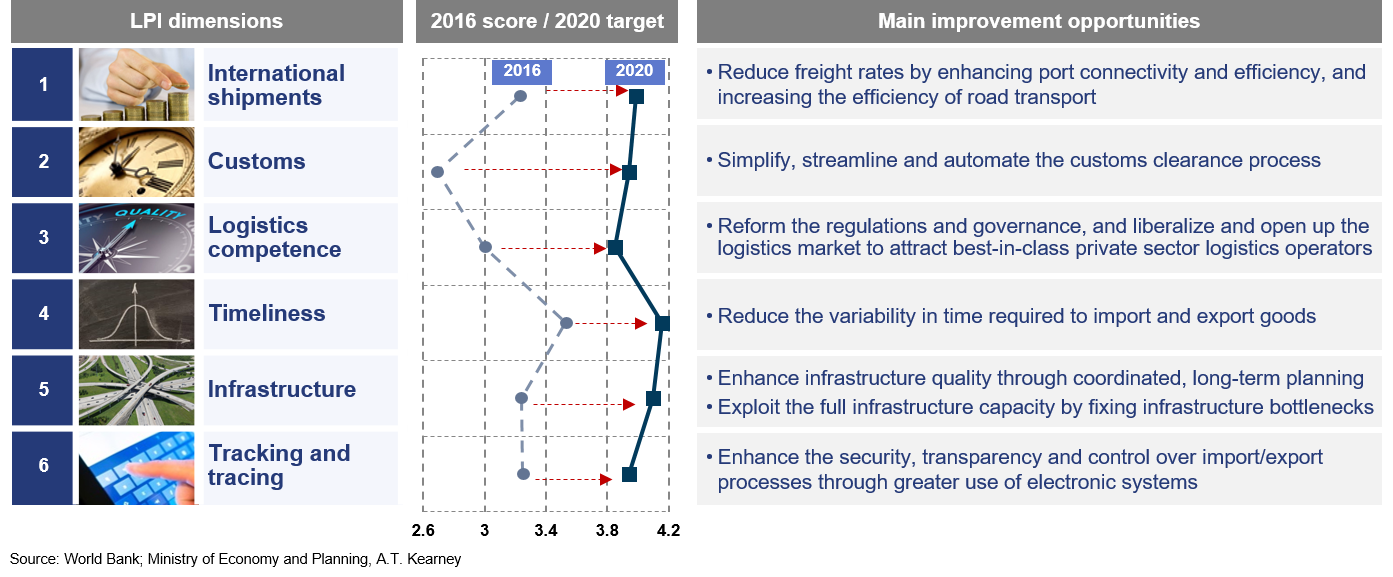

Saudi Arabia aims to take advantage of these strategic assets and turn to the best and lowest cost option for distribution to the Arabian Peninsula, Mashriq, Levant, and East Africa while improving the logistic service quality, infrastructure and tracking services to global levels. Figure 2 shows Saudi Arabia's position on the Logistics Performance Index (LPI). That is issued by the World Bank, and the levels that must be reached to achieve the goals set.

Figure 2: Saudi Arabia in 2016 and its goals in 2020 on the Logistics Performance Index.

The Kingdom strategy and the early gains

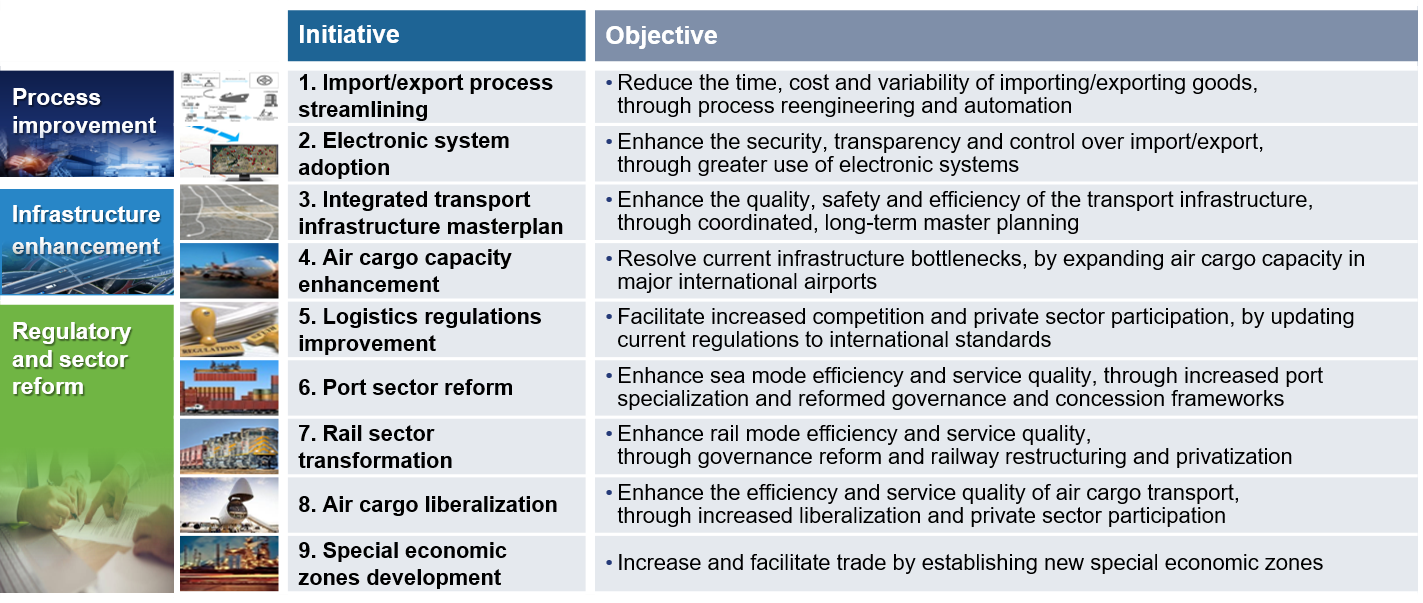

TTo achieve its vision to become a logistics hub, the Kingdom launched a program of nine initiatives to promote the logistics service sector (see Figure 3).

Figure 3:: Saudi Arabia logistics sector improving program

Figure 3:: Saudi Arabia logistics sector improving program

-

Imports and exports.

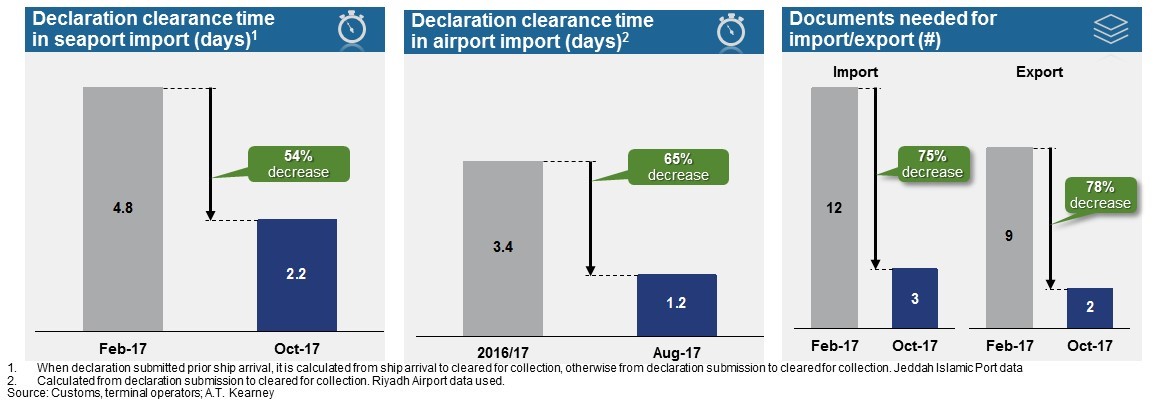

Saudi Arabia was able to reduce time and cost, as well as increase the regularity in the import of goods and merchandise by re-engineering the process and relying more on mechanization. The average time of customs clearance in seaports declined by half to 2.2 days and at airports to 1.2 days; The number of paper documents to be attached to import and export work also fell by 75 per cent (see figure 4).

Figure 4: Early gains of Facilitating the customs operations

TThe degree of regularity in the clearance process has improved significantly, with 40% of customs data being released at seaports within 24 hours, and 70% within 48 hours.These results were achieved after the application of data submission before the arrival of shipments system , and the use of technology in clearing the data, increasing customs work hours to 24/7, reducing the level of manual inspection by promoting the risk management process and increasing the cooperation and integration of government authorities that involved in the import / export process. -

Digital transformation.

Technology helps to improve security and transparency in import and export operations. Today, importers can track the case of their cargo and its current location moment by moment. Customs brokers also receive electronic notifications on their mobile phones regarding the case of their shipments, as well as notifications before their shipments arrival, to notify that the shipment statement is available on the portal and thus the possibility of initiating customs data procedures .Newly , the Kingdom has launched the marine ports system to ensure the exchange of information are safe and effective, this system includes operations carried out on board ships, and operations in ports, digital payment, management of trucks and so on . A similar system for airports is being developed now. -

Transportation and infrastructure. :

Saudi Arabia has developed a new main plan for infrastructure in the transport sector that aimed to improve the quality, safety and efficiency level of the sector. The plan aims to develop the infrastructure, including the land bridge project, which will link between east and west coasts of the Kingdom, and a new two tracks which are the railway line, that will link between the GCC countries in the east, and Yanbu- Jeddah in the west (passing through King Abdullah port - King Abdullah Economic City ).Soon enough, new multi-mode logistics stations to meet the increasing demand for interconnections between the sea, the air and between railways and land.

-

Air cargo. .

Saudi Arabia is currently upgrading its airports and expanding air cargo facilities to overcome issues caused by the Limited capacity of specialized facilities to air cargo. The objective is to increase the total of specialized capacity for air cargo in the Kingdom from 0.8 million tons / year at present to 6 million tons / year in 2030.

-

Laws and Regulations. .

If Saudi Arabia hopes to attract more competition and participation from the private sector, regulations and laws must be able to meet international standards .The Kingdom is well aware of this, and it will not be long before the customs brokers career becomes available to those who in the manufacturing and logistics sectors, which is a major step towards achieving the required professionalism level .Licensing laws for land transport services and warehouse operators are subject to review in an effort to improve efficiency, quality and safety standards .

-

Maritime Ports

Significant efforts are under way to improve efficiency and quality of service in maritime ports by increasing the level of port privatization, reforming the governance process, and modernizing concession frameworks .The establishment of the concerned company with the organization of the new ports at the beginning of efforts to privatize and institutionalize on the port sector. The company is currently reviewing the concession frameworks to make it more transparent, fair and attractive to operators of international terminals (Who they already enjoying with the firm global position in the Kingdom), As well as for local operators, who are constantly increasing in this time

-

The Railway Sector .

is undergoing a similar reforms Last year, the regulatory side of the property was separated and outsourced to an independent regulator ( Public Transport Authority - Railway Sector ).The government is currently integrating the managing all railway operations and planning for the operation and maintenance contracts for freight and passenger services for internationally experienced operators .In the future, new infrastructure in the railway sector could be financed through public-private partnerships.

-

Private sector.

The Kingdom has recently franchising a number of private companies to manage operations in some airports to develop and operate a number of services. These airports include King Abdulaziz International Airport in Jeddah and the new cargo terminal at King Fahad International Airport in Dammam .at the moment, plans are under way for King Khalid International Airport in Riyadh to increase private sector participation.

-

Special economic zones.

Saudi Arabia aims to reduce costs and reduce issues to business activities, trade support forms, and attracting foreign direct investment. Plans are under study for the development of a number of new special economic areas characterized by convenient procedures for commercial activities, positive tax policies, areas for customs warehouses, and efficiency in linking transport.

- New points attract the kingdom economic through promising investments

Saudi Arabia has a central location and a large economy, which is an individual advantage that qualify to transform the Kingdom into an important regional logistics hub. However, since only size and location can be relied upon, the Kingdom has embarked on a program to improve the logistic services, including streamlining of imports and exports, improving infrastructure, governance reform and regulatory aspects, and liberalization and privatization of the market. the Kingdom has already been able to make early gains, including reducing the period of customs clearance, customizing the customs process, expanding the capacity of major transport assets and awarding many concession contracts to private operators. The Kingdom will not stop there. As the logistics sector gains more strength and volubility investors are still looking at opportunities in the sector.